We love new technology here at Magnifica so on the day a new system launches in the UK for sending payments to a mobile phone number we just had to give it a go. Paym allows individuals to send payments direct to another person using just their mobile number.

Using the HSBC mobile banking app I was quickly able to set up new service and send my first Paym payment to my brother over at @PHOTOSinCOLOR. Ed now owes me £1....maybe he'll test the system and send it back.

Find out how easy it is to set up below.

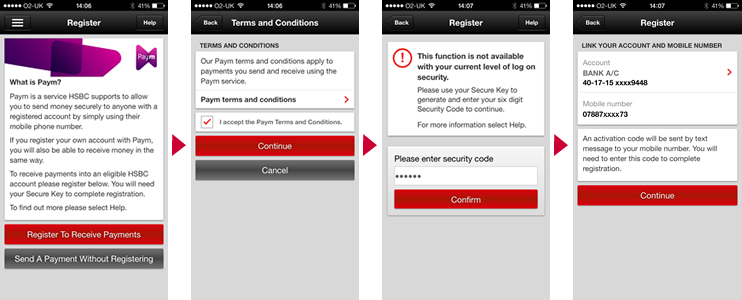

Registering for the service

A simple setup wizard takes you through the registration process asking you to agree to standard T&C's, use your Internet Banking Security device to generate a security code and tap continue.

Choose a bank account to use for Paym and enter your mobile phone number and you're pretty much done.

Confirmation and Payment limits

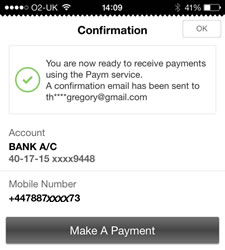

After a short pause you'll see a confirmation page and an email will arrive in your inbox confirming that you are now ready to start sending and receiving Paym payments.

Looks like the system is working well and HSBC have made the process simple and intuitive to navigate.

So it looks like in about 3 minutes I am setup and ready to make my first payment. Next time I enter the Paym screen within the mobile app I am asked to choose a daily payment limit. This is defaulted to £250 but can be reduced to as little as £5 per day.

So that's it now I can make my first Paym payment.

Making your first Payment

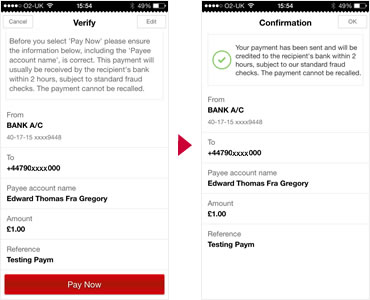

Tapping the Paym logo takes you right to the Paym payment screen. First you are asked to choose a bank account to send the payment from, I assume that if you only have one this will be pre-selected for you.

Next you are asked to enter the mobile phone number you want to send payment to - standard iOS integration is used here with the well understood "xxx would like to access your contacts - Yes / No" message appearing. Tap yes and select a contact.

Now enter the amount and a payment reference and tap Continue to send the payment.

A verify screen is shown with a Pay now button at the bottom. Tapping Pay now take you to a confirmation screen and the payment has been made.

The confirmation screen says that payment will be received within 2 hours however this test completed in under a minute. Ed called me to say that the payment had landed in his account pretty much immediately!

Conclusion

During limited testing it appears that the Paym technology is an easy to use method of transferring funds via a mobile phone number. Time will tell how often I will use it and for what kind of transactions but on the whole it works well and I'm keen to start using it for real over the next few weeks.

From a personal point of view I can see me using Paym however it will be interesting to see how this is picked up by businesses....maybe your local Takeaway will change to a mobile number rather than a local phone number!